符合资格人士如何通过QFI途径启动投资程序?

打算通过QFI路线进行投资的合格人员可以联系任何在SEBI注册的合格DP。 合格的DP被授权执行规定的KYC,并确保在允许申请人开设demat账户作为QFI之前满足必要条件。

How does an eligible person initiate the process to make investment through QFI route?

Ans. An eligible person intending to make investment through QFI route may contact any of the qualified DP registered with SEBI. The qualified DPs are mandated to perform the prescribed KYC and ensure fulfilment of the requisite conditions before allowing the applicant to open a demat account as QFI.

有没有关于合格DP的清单?

合格DPs清单可咨询际连企服

Is there any list of qualified DPs available?

Ans. The list of qualified DPs can consult Jilian Consultants

对正在进行的QFI的KYC有哪些要求?

每个QFI都将按照SEBI和RBI规定的方式,广泛适用于印度投资者的每个QFI程序,以及关于在印度AD Category-I银行开设的单一无息卢比账户的KYC程序的现行指南。

What are the requirements for ongoing KYC of QFIs?

Ans. Every QFI shall undergo the same KYC procedure on an ongoing basis, as is applicable for Indian investors, in the manner as prescribed by SEBI and RBI, from time to time as well as extant guidelines on KYC procedures for single non-interest bearing Rupee account opened with AD Category-I bank in India.

KYC需要提交哪些文件?

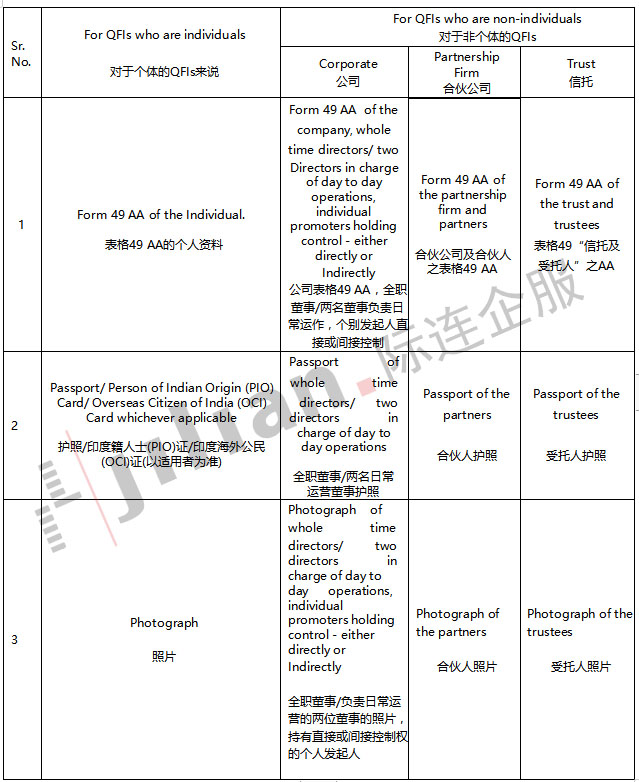

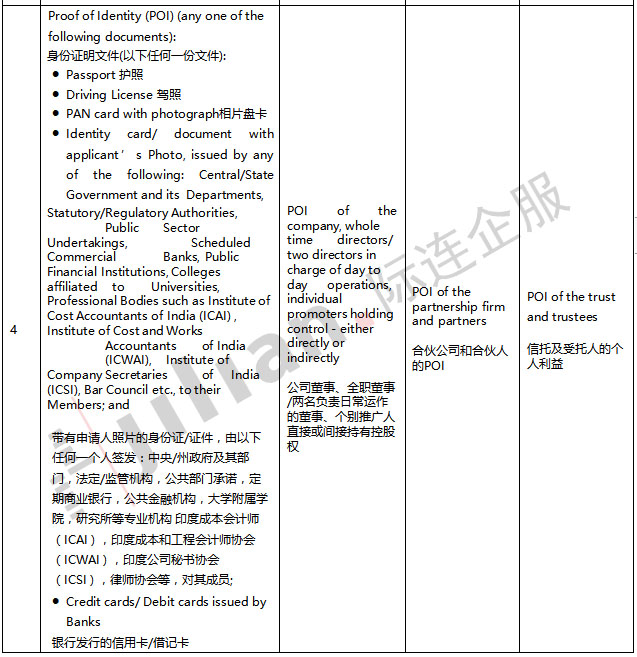

以下是2011年8月22日SEBI视频通告CIR / MIRSD / 16/2011和2011年10月5日MIRSD / SE / Cir-21/2011规定的QFI为KYC提交的文件清单:

What documents are required to be submitted for KYC?

Ans. Following is the list of document to be submitted by a QFI for KYC as prescribed by SEBI vide circulars CIR/MIRSD/16/2011 dated August 22, 2011 and MIRSD/SE/Cir-21/2011 dated October 05, 2011:

申请人提交的所有文件副本均须自行证明,并须附有正本以供核对。如果没有出示任何文件的正本以供核实,则副本应由获授权证明文件的实体进行适当的证明

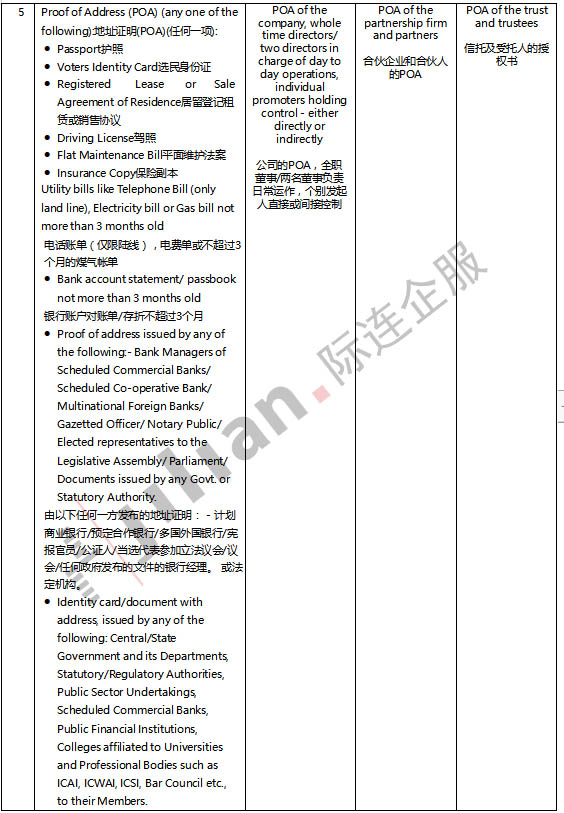

除上述文件外,下列文件应由非个人提交:

Copies of all the documents submitted by the applicant should be self-attested and accompanied by originals for verification. In case the original of any document is not produced for verification, then the copies should be duly attested by entities authorized for attesting the documents.

Following documents shall be submitted by non individuals in addition to the above- mentioned documents:

谁能证明提交给KYC的文件

所有提交KYC的文件的原件应连同副本一起提交审核。如未提交正本,则副本须经下列任何一项人士证明:

● 公证人,宪报官员,预定商业/合作银行经理或跨国外资银行(名称,名称和印章应附在副本上)

● 如果是NRIs / QFIs,公证人,法院裁判官,法官,在印度注册的定期商业银行海外分支机构的授权官员,在客户所在国家的印度大使馆/总领事馆。 [“预定银行”是指包括在1934年“印度储备银行法”第二附表中的银行,该法还包括一些外国银行。

Who can attest the documents which are submitted for KYC?

Ans. Originals of all the documents submitted for KYC shall be submitted along with the copies for verification. If a original is not submitted then the copy has to be attested by any one of the following:

Notary Public, Gazetted Officer, Manager of a Scheduled Commercial/ Co- operative Bank or Multinational Foreign Banks (Name, Designation, & Seal should be affixed on the copy)

In case of NRIs/QFIs,, Notary Public, Court Magistrate, Judge, authorized officials of overseas branches of Scheduled Commercial Banks registered in India, Indian Embassy/ Consulate General in the country where the client resides. [The “scheduled bank” means a bank included in the Second Schedule of the Reserve Bank of India Act 1934 which also includes some foreign banks.

QFI是否需要经过“亲自验证”?

个别QFI投资者须“亲自核实”,比如非本地客户。

对于包括QFI在内的非居民客户,海外股票经纪人当地办事处的员工可以进行面对面的验证。 此外,考虑到股票经纪人员对非居民客户进行“亲自核实”的不可行性,公证人,法院,裁判官,法官,已登记商业银行海外分支机构的授权官员对KYC文件的认证 在印度,可允许客户所在国的印度大使馆/总领事馆。

Does a QFI required to undergo "In Person Verification"?

Ans. "In Person Verification" is required in case of individual QFI investors as applicable for non-resident clients.

In case of non-resident clients including QFIs, employees at the stock broker’s local office, overseas can do in-person’ verification. Further, considering the infeasibility of carrying out ‘In-person’ verification of the non-resident clients by the stock broker’s staff, attestation of KYC documents by Notary Public, Court, Magistrate, Judge, authorized officials of overseas branches of Scheduled Commercial Banks registered in India, Indian Embassy / Consulate General in the country where the client resides may be permitted.

合格DPs的角色和职责

是否要求合格DPs遵守其开展业务的所有司法管辖区的法律、规则和规章?

合格DP必须遵守现有的法律,法规和管辖区域,以合格的DP的身份开展业务,例如招揽投资。

Are qualified DPs required to comply with laws, rules and regulations of all jurisdictions where they carry out their operations?

Ans. The qualified DPs are required to comply with the extant laws, rules and regulations of jurisdictions where they carry out their operations in the capacity of qualified DP, such as solicitation of investments.

若合格的产地来源证不符合或违反指引/声明/通告,合格的产地来源证可采取什么行动?

如果QFI有任何违规行为,合格的DP有义务将此类情况通知相关保管人和SEBI

What action can a qualified DP take in case a QFI does not comply or violates guidelines/declaration/circulars?

Ans. In case of any violations by QFI a qualified DP is obliged to bring such instances to the notice of concerned depository and SEBI.

合格的DP如何确保对其他客户的保护?

合格的DP不得就QFI做出任何使其任何其他客户处于不利地位的行为或行为。合格的DP应公平公正地对待其QFI客户。

How does the qualified DP ensure protection of his other clients?

Ans. The qualified DP shall not perform any acts or deeds with regard to QFI that puts any of his other client(s) at an disadvantageous position. The qualified DP shall deal with its QFI clients in a fair and impartial manner.

合资格的DP须向QFI作出什么声明/承诺?

合格的DP应不时取得存管机构规定的适当声明/承诺。

What declarations/undertakings are to be obtained from QFI by a qualified DP?

Ans. The qualified DP shall obtain appropriate declarations/undertakings as prescribed by depositories from time to time.

合格的DP向存管机构报告QFI持仓情况的格式是什么?

合格的DP应按各存管机构规定的格式不时报告QFI持仓情况。

What is the format for reporting of QFI holdings by a qualified DP to the depositories ?

Ans. The qualified DP shall report QFI holdings in the format prescribed by the depositories from time to time.

QFI的交易前限额是否由合格的DP监控?

是的。合格的DP仅在检查了适用的限额之后才将订单传到代理。

Whether the pre trade limit of QFI is monitored by qualified DP?

Ans. Yes. The qualified DP will route the order to the broker only after checking applicable limits.

相关文章:

有关合格境外机构投资者常见问答系列之合格境外机构投资者合格机会

有关合格境外机构投资者常见问答系列之合格境外机构投资者投资机会和选择

际连企服

www.ijilian.com www.investtoindia.com

际连海外投资部咨询热线:

021-60710208(上海) 0755-23941595(深圳)

邮箱:info@ijilian.com

上海市共和新路912号509室

深圳市福田区滨河大道9289号京基滨河时代大厦A座6519室 |