谁是合格的境外机构投资者?

简言之,合格的境外机构投资者应包括个人、团体或协会,属于金融行动特别工作组(FATF)成员国家的居民,并且属于FATF成员并居住在签署国的集团成员的国家 国际证监会组织的MMOU(附录A签署国)或与印度证券交易委员会(SEBI)签署的双边谅解备忘录。QFI不包括FII /子账户/外国风险投资投资者。

Who is Qualified Foreign Investors (QFI)?

Ans. In brief, QFIs shall include individuals, groups or associations, Resident in a country that is a member of Financial Action Task Force (FATF) or a country that is a member of a group which is a member of FATF and resident in a country that is a signatory to IOSCO’s MMOU (Appendix A Signatories) or a signatory of a bilateral MOU with Securities and Exchange Board of India (SEBI). QFIs do not include FIIs/Sub accounts/ Foreign Venture Capital Investor.

哪些国家的居民有资格作为QFI投资?

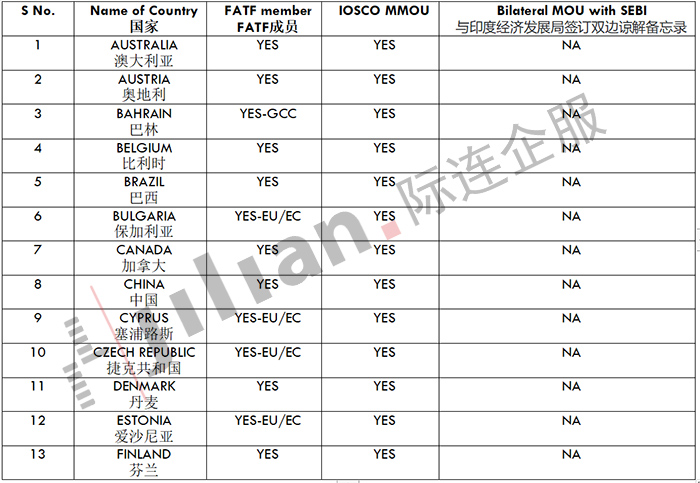

下列国家的居民有资格按照上文第1条的定义以合格投资者身份投资。

Residents of which countries shall be eligible to invest as QFIs?

Residents of the following countries shall be eligible to invest as QFI as per the definition mentioned in Sr. No. 1 above.

免责声明:QFI框架已于2011年8月9日和2012年1月13日的SEBI通函以及随后的有关此事的通告中落实到位。

这些常见问题解答旨在帮助QFI申请人获得对该框架的大致理解。 这些常见问题解答不能用于法院以任何方式解释任何通告,规则,法规等。

当监管环境发生变化时,我们会更新常见问题解答。

Disclaimer: The QFI framework has been put in place by SEBI circulars dated August 09, 2011 and January 13, 2012 and subsequent circular on the matter.

These FAQs are prepared with a view to help QFI applicants to get generic understanding of the framework. These FAQs cannot be used in a court of law to interpret any circular, rules, regulations, statutes etc., one way or the other.

While the FAQs are updated as and when the regulatory environment undergo changes.

上述清单是根据FATF和IOSCO网站截至2012年8月17日提供的信息编制的。欧盟委员会(EC)是欧盟(EU)的执行机构,是FATF的成员。 因此,欧盟被认为是符合条件的国家。 请注意,此列表可能会有所变化。 因此,您需要访问相关网站以获取更新的详细信息。

The above list has been prepared based on the information as available on websites of FATF and IOSCO as on August 17, 2012. European Commission (EC), an executive body of European Union (EU), is a member of FATF. Hence, EU has been reckoned for the purpose of eligible countries. Please note that this list is subject to change. Therefore, you are requested to access the relevant websites for updated details.

非居民印第安人(NRI)可以通过QFI路线开立一个demat账户进行投资吗?

NRI不能通过QFI路线和证券投资计划(PIS)路线同时进行投资。 但是,NRI可以开立demat账户作为QFI,并通过这条路线进行投资,前提是他已经关闭了所有作为NRI开立的demat账户。

Can a Non Resident Indians (NRI) make investments by opening a demat account through QFI Route?

Ans. An NRI cannot make investments simultaneously through the QFI route and portfolio investment scheme (PIS) route. However, a NRI can open demat account as QFI and make investments through this route provided he has closed all his demat account(s) opened as an NRI.

同一个人/主体可否通过外国直接投资(FDI)及合格境外机构投资者(QFI)途径进行投资?

可以。 同一个人/主体可以通过FDI和QFI路线进行投资。 但是,如果一个人通过外国直接投资和QFI途径投资同一个公司,则该人在公司中的总持有量不得在任何时间超过公司有偿权益资本的百分之五。 该限额适用于具有独立且不同的国际证券识别号(ISIN)的每类股权。 这应遵守印度政府(GoI)和印度储备银行(RBI)不时规定的外国直接投资准则。 有关ISIN的列表,请访问NSDL网站。

Can the same person/ entity make investments through Foreign Direct Investment (FDI) and QFI routes?

Ans. Yes. The same person/ entity can make investment through FDI and QFI route. However, where a person invests in a company through both FDI and QFI route, the aggregate holding of such person in the company shall not exceed five percent of paid up equity capital of the company at any point of time. This limit shall be applicable to each class of equity shares having separate and distinct International Securities Identification Number (ISIN). This shall be subject to guidelines on FDI as prescribed by Government of India (GoI) and Reserve Bank of India (RBI) from time to time. For list of ISINs please check the NSDL website.

QFI的最高持股限额是否有任何上限?

是。 在任何时间点,QFI的总股权不得在任何时间超过任何公司的已缴股本的5%。 该限额适用于具有独立和不同ISIN的每类股权。 此外,就具有独立且不同的ISIN的每个股权类别而言,所有QFI的总股权在任何时间点不得超过公司已缴股本权益的百分之十。

Is there any cap on the maximum shareholding limit by QFI?

Ans. Yes. The total shareholding by a QFI cannot exceed five percent of the paid up equity capital of any company at any point of time. This limit shall be applicable to each class of equity shares having separate and distinct ISIN. Further, the aggregate shareholding of all QFIs shall not exceed ten percent of the paid up equity capital of the company at any point of time, in respect of each equity share class having separate and distinct ISIN.

谁是终极受益所有者?

最终实益拥有人是最终拥有,控制或影响客户和/或代表其进行交易的自然人。 它还包括对法人或安排实施最终有效控制的人员。 终极受益所有人的定义是根据SEBI主要关于反洗钱(AML)和打击恐怖主义融资(CFT)AML / CFT的通告提供的。 合格存管参与者(QDP)应遵守由SEBI不时更新的SEBI Master AML / CFT通告。

Who is an Ultimate Beneficial Owner?

Ans. The ultimate beneficial owner is the natural person or persons who ultimately own, control or influence a client and/or persons on whose behalf a transaction is being conducted. It also includes those persons who exercise ultimate effective control over a legal person or arrangement. The definition of Ultimate Beneficial Owner is provided under the SEBI Master circular on anti-money laundering (AML) and combating the financing of terrorism (CFT) AML/CFT. The Qualified Depository Participant (QDP) shall be guided by the SEBI Master circular on AML/CFT as updated by SEBI from time to time.

同一组最终实益拥有人可以使用多条途径来引导印度股票的投资吗?

不可以,除非是外商直接投资,同一组有意通过QFI途径进行投资的最终实益拥有,不得直接或间接使用NRI,FII,Sub账户或FVCI等其他可用途径,将投资引导成印度股票 。

Can the same set of ultimate beneficial owner(s) use multiple routes to channelize investments in Indian equities?

Ans. No. Except for FDI, the same set of ultimate beneficial owners(s), who intend to make investments through the QFI route, shall not directly or indirectly channelize investments simultaneously into Indian equities using any other available route such as NRI, FII, Sub Account or FVCI.

什么是不透明的结构?

任何结构如细胞保护公司(PCC),细胞隔离公司(SPC)或类同结构应被视为不透明结构。 虽然没有详尽的不透明结构清单,但合格的DP应遵循以下原则:

● 最终受益所有人的详细信息应该随时可访问。 最终实益拥有人的定义根据SEBI Master AML / CFT通函提供。 合格的DP应由SEBI不时更新的AML / CFT的SEBI Master通告指导。

● 该结构不应该圈划不同资金池的资产和负债。

● 该结构不应圈划执法资金池。

What is an opaque structure ?

Any structure such as Protected Cell Company (PCC), Segregated Cell Company (SPC) or equivalent should be deemed to be opaque structure. While there is no exhaustive list of opaque structures, the qualified DP should be guided by the following principles:

● The details of ultimate beneficial owner(s) should be accessible at all the times. The definition of ultimate beneficial owner is provided under the SEBI Master circular on AML/CFT. The qualified DP shall be guided by the SEBI Master circular on AML/CFT as updated by SEBI from time to time.

● The structure should not ring fence the assets and liabilities of different pools of fund.

● The structure should not ring fence the pools of funds from enforcement.

关注了解更多资讯

际连企服

www.ijilian.com www.investtoindia.com

际连海外投资部咨询热线:

021-60710208(上海) 0755-23941595(深圳)

邮箱:info@ijilian.com

上海市共和新路912号509室

深圳市福田区滨河大道9289号京基滨河时代大厦A座6519室 |